A private market secondary transaction allows investors to buy and sell stakes before major liquidity events like an IPO.

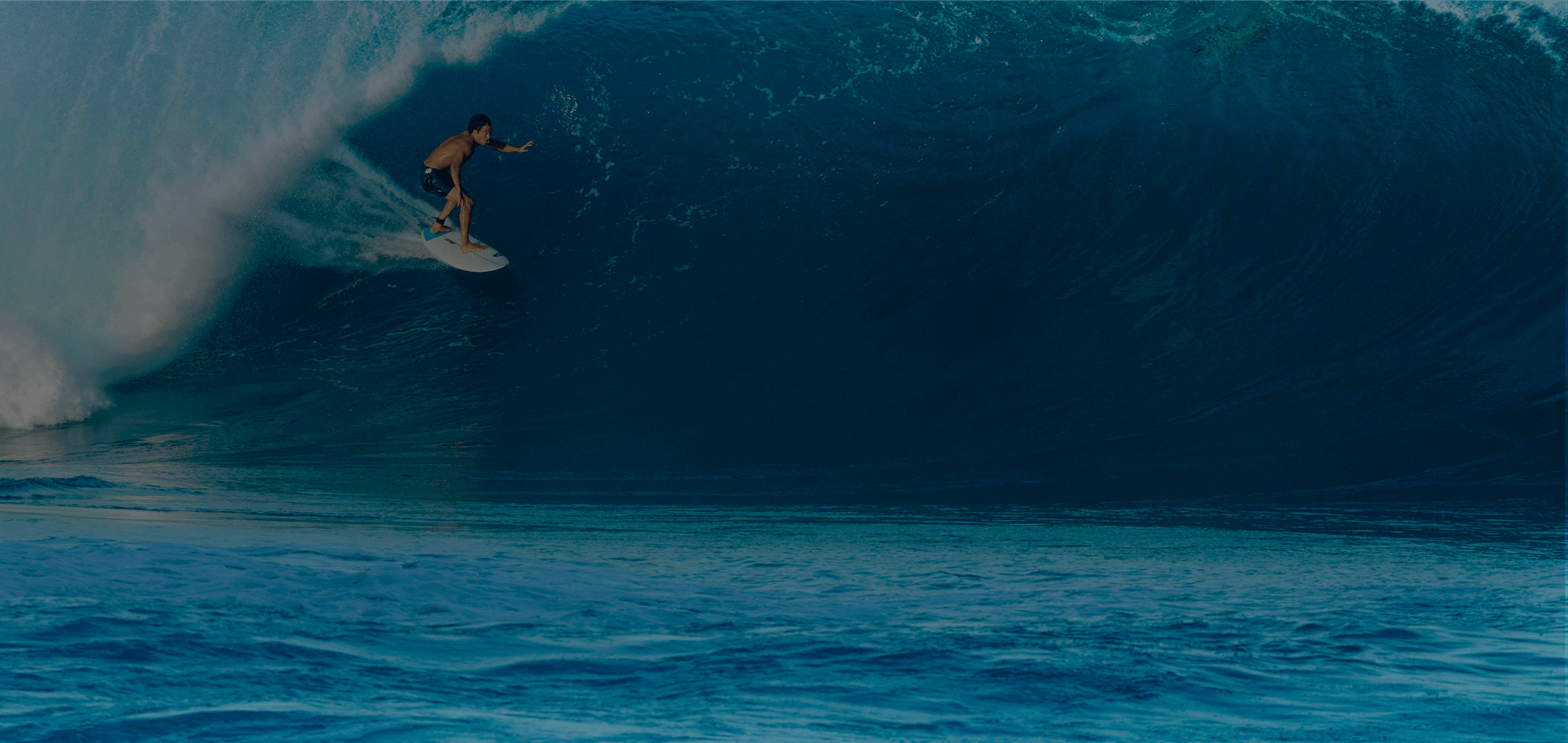

As one of India's first secondaries funds, White Whale is charting new waters in this largely unexplored territory.

The sample size includes Indian VC and PE Funds (AIFs) investing only in equity schemes and as per criteria benchmark considered from vintages FY14 to FY21 and completed 1 year from first close.

Source: CRISIL

Private Equity

Public Markets

Investment Banking